Adoption Disruption Insurance in Florida

You can protect your family's financial future by securing adoption disruption insurance through a licensed, transparent adoption agency like American Adoptions of Florida.

While most adoption journeys end with the joyful placement of a child, private infant adoption includes the risk of a disruption. By choosing a Florida-licensed agency with built-in financial protection, you ensure that an unexpected change in a birth mother's plan doesn't become a permanent financial roadblock to growing your family.

We are here to answer your questions about what happens if an adoption falls through, explain how our Risk-Sharing Program provides an adoption refund, and show you why adoption disruption insurance is the most effective way to avoid the hidden costs of adoption in Florida.

What Is Adoption Disruption Insurance in Florida?

In Florida private adoption, adoption disruption insurance (also known as a Risk-Sharing Program) is a financial safeguard designed to protect the investment of adoptive parents.

Under Florida statute, adoptive families are legally permitted to pay for a birth mother's reasonable living and medical expenses.

However, Florida law also protects the rights of the expectant mother; she cannot sign her final legal consent for adoption until at least 48 hours after the child's birth or upon her discharge from the hospital. If she chooses to parent during this period, the adoption "disrupts."

Without insurance, the money you invested into the process is gone. Adoption disruption insurance acts as a safety net, ensuring that if a match does not result in a placement, your funds are returned to you.

How Often Do Adoptions Fall Through?

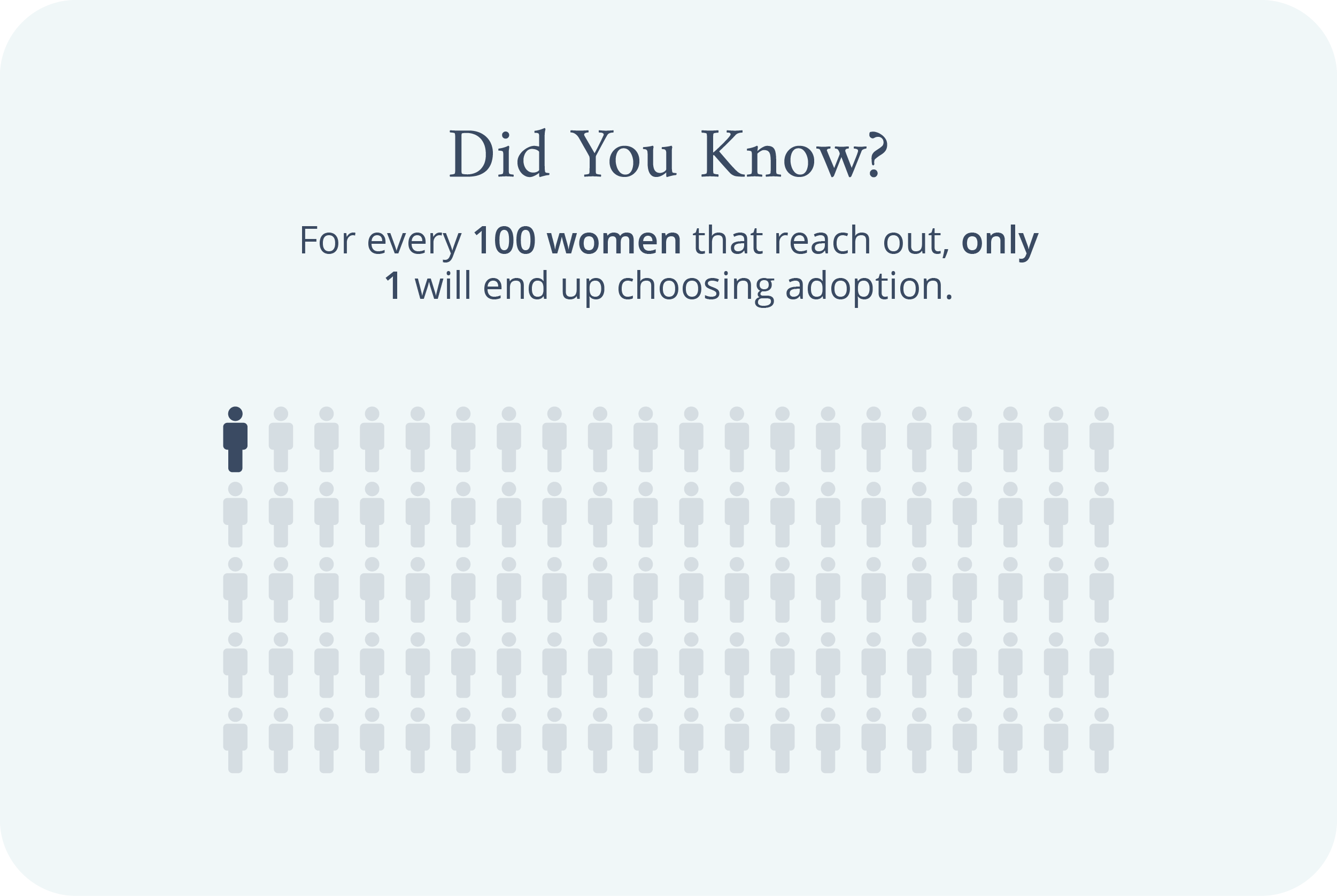

Many women who reach out to adoption agencies end up choosing to parent early.

If a woman continues the process and chooses adoption, she usually goes through with it. However, “usually” doesn’t mean always. Nationwide and in Florida, approximately 10% to 25% of adoption matches disrupt before finalization.

These disruptions usually occur because an expectant mother, after receiving counseling and holding her baby, realizes she has the emotional desire and resources to parent her child.

- It is not your fault: A disruption is a deeply personal decision made by the birth parent and is never a reflection of you as an adoptive family.

- It is her legal right: The mandatory 48-hour/discharge waiting period exists to ensure her decision is made with absolute certainty.

Adoption Disruptions: A Hidden Cost Many Families Don’t Anticipate

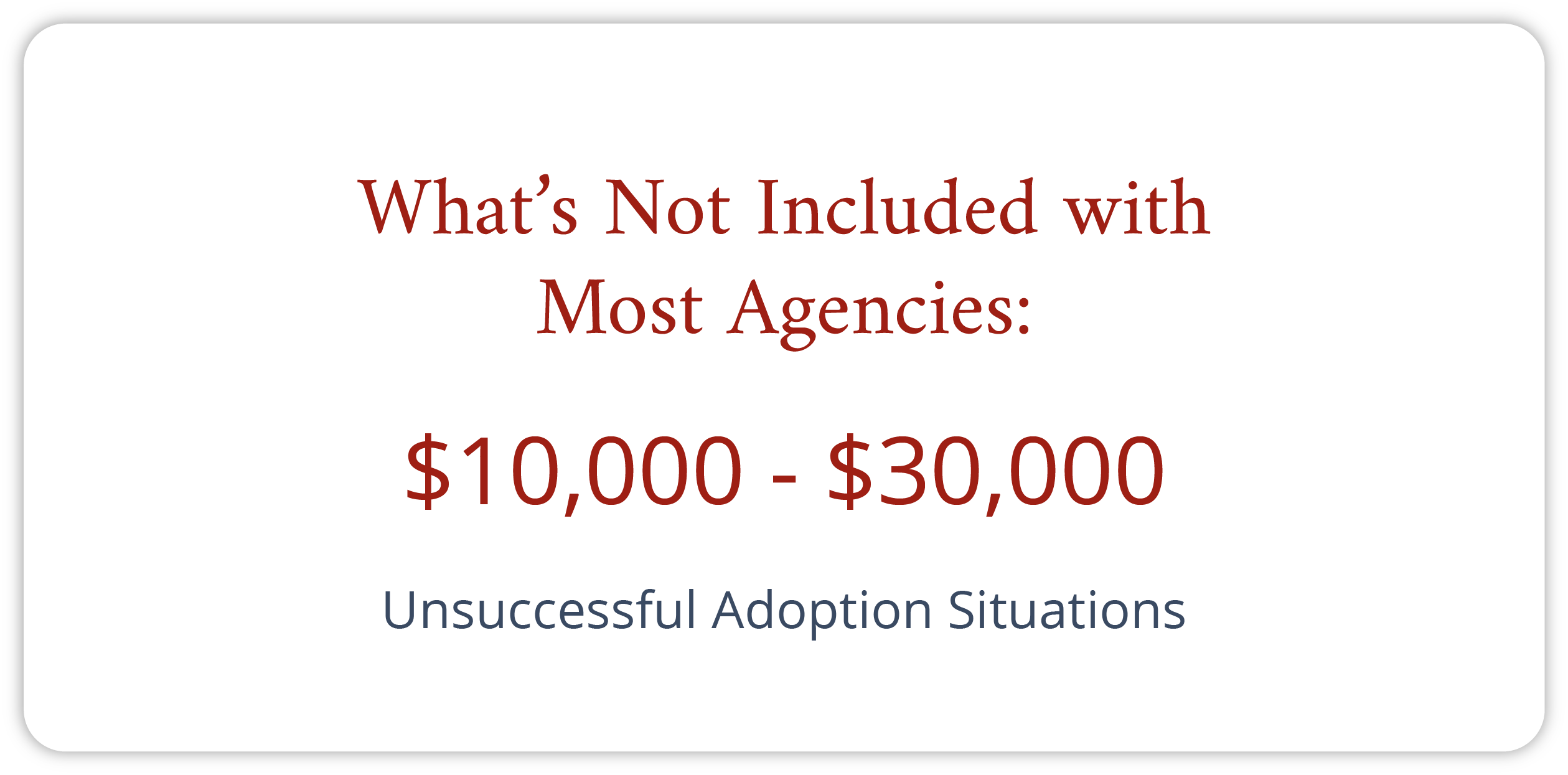

Families often ask why some adoption agencies are cheaper than others. The answer frequently lies in what happens when things go wrong. Many "low-cost" agencies or unlicensed facilitators appear affordable on paper because they do not offer quality services or any form of financial protection.

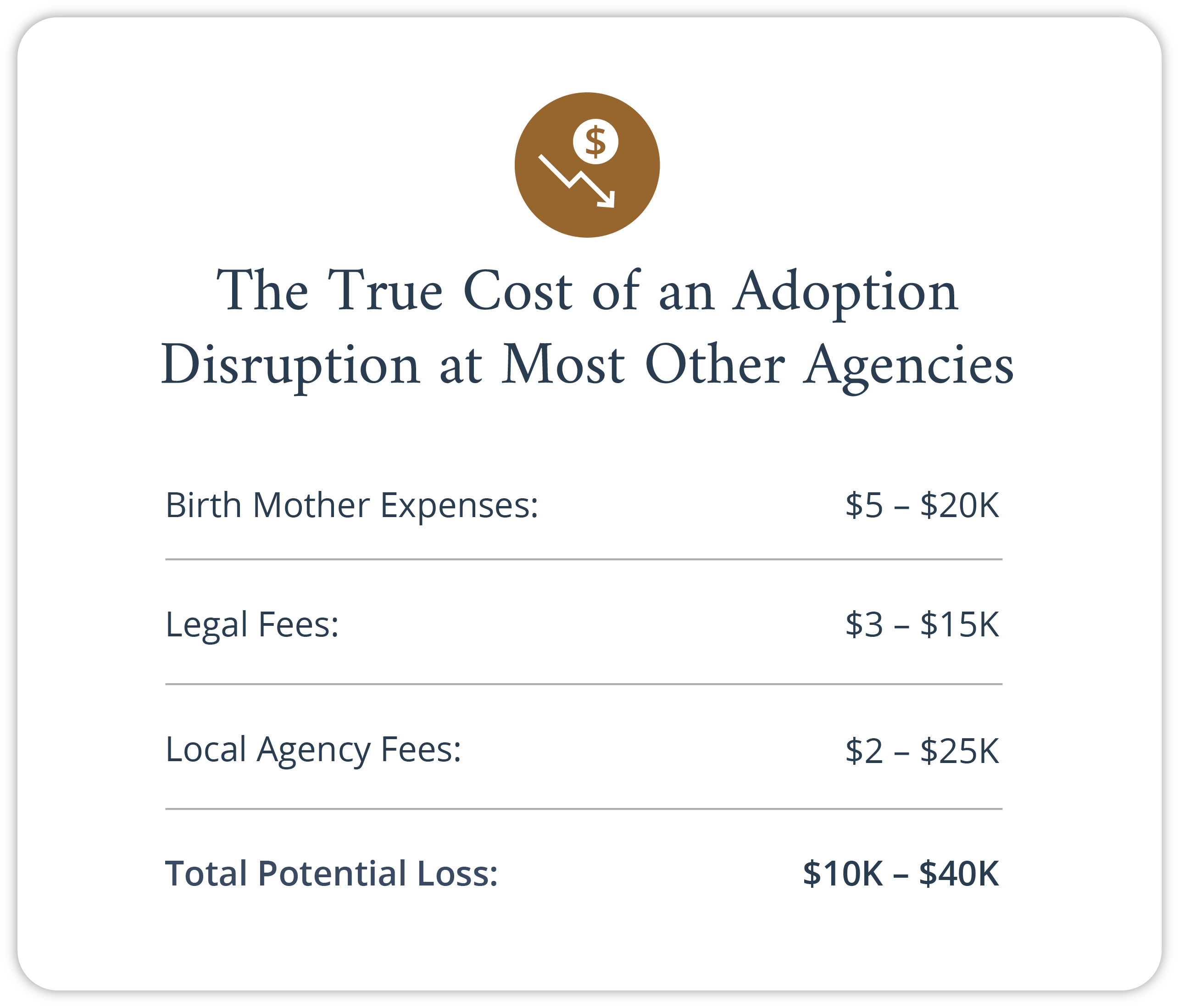

If an agency does not have adoption disruption insurance, a failed match becomes one of the most devastating hidden costs of adoption.

You are left to absorb the total financial loss. This means you would have to pay the same activation and living expense fees all over again to try for a second match. At American Adoptions of Florida, our costs include built-in financial protection so you don't lose time or money if you need to rematch.

What Costs Are at Risk During an Adoption Disruption?

To understand why this protection is so vital, it helps to see exactly what expenses you incur prior to placement that are typically non-refundable at other agencies.

Can We Adopt Again After a Disruption?

Absolutely. The emotional toll of a disruption is heavy, but the primary goal of adoption disruption insurance is to ensure it is not the end of your journey.

With a true Risk-Sharing Program, families can be refunded for expenses and can continue on in their family building journey. Instead of "rolling over" your funds and trapping you in a contract, you receive a direct adoption refund for your lost expenses.

This allows you to re-enter the matching process without starting from financial zero, helping you successfully adopt when your heart is ready.

How Adoption Disruption Insurance Works with a Florida-Licensed Agency

Here is how our Risk-Sharing Program works:

- Built-In Protection: A portion of your initial agency fee funds the Risk-Sharing Program.

- No Fault Required: If the birth mother changes her mind, or if the situation disrupts for medical or legal reasons out of your control, the policy triggers.

- Direct Refund: We issue a direct refund of the qualified lost expenses to you. You have the freedom to use those funds to immediately pursue a new match with us, take a break, or go in a different direction.

Does Every Adoption Agency Offer Disruption Insurance?

No. In fact, comprehensive adoption disruption insurance is incredibly rare. Many small, local firms and unlicensed facilitators explicitly state that all fees are at-risk and non-refundable.

We believe that asking hopeful parents to shoulder 100% of the financial risk is an unacceptable industry practice. You should always ask an agency what happens if an adoption disrupts before decide which agency helps you.

How American Adoptions of Florida Supports Families Through Disruption

We understand that an adoption disruption is a profound emotional loss before it is a financial one. As a Florida-licensed agency, we are proactive in our protection. Our team provides the counseling you need to process the outcome, and the financial protection you need to move forward.

Protect your journey and your family's future. Contact American Adoptions of Florida to learn more about our Risk-Sharing Program and how we eliminate the hidden costs of adoption.

Disclaimer

Information available through these links is the sole property of the companies and organizations listed therein. American Adoptions provides this information as a courtesy and is in no way responsible for its content or accuracy.